Understanding Bankruptcy: A Comprehensive Guide

- Andrew Sandavol

- Feb 18, 2024

- 4 min read

Introduction

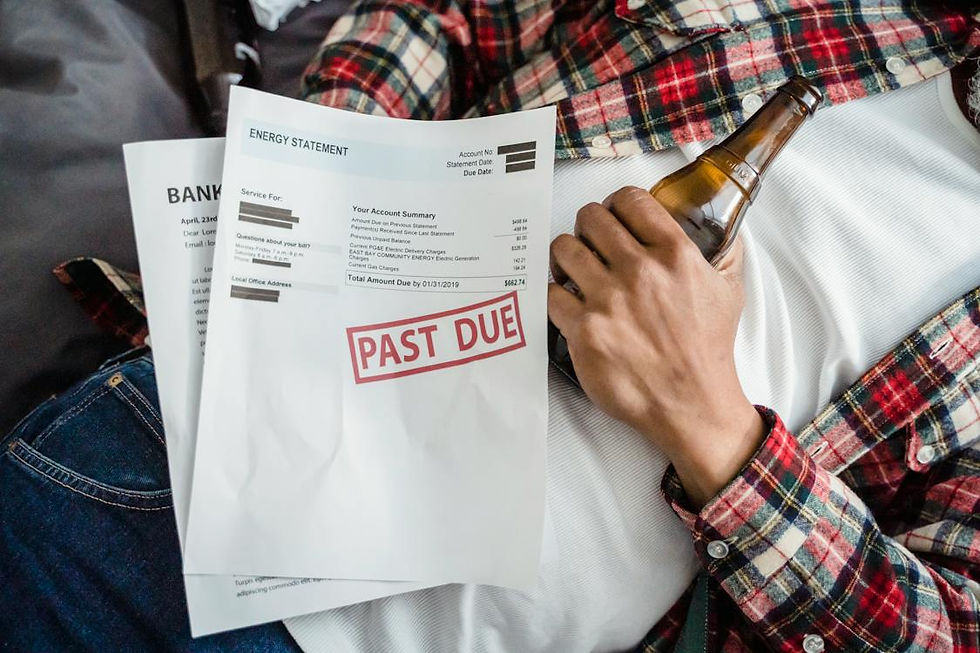

Bankruptcy is a legal process designed to provide relief to individuals and businesses struggling with overwhelming debt. While it's often viewed negatively, bankruptcy serves as a crucial tool for financial restructuring and a fresh start for those burdened by unmanageable financial obligations. In this article, we'll explore what bankruptcy entails, how it happens, the process involved, and strategies for avoiding it.

Section 1: What is Bankruptcy?

Bankruptcy is a legal proceeding initiated by individuals or businesses unable to repay their outstanding debts. It provides a framework for the orderly resolution of financial obligations, offering relief to debtors while ensuring fair treatment for creditors. There are several types of bankruptcy filings, each tailored to specific circumstances and objectives:

Chapter 7 Bankruptcy:

Often referred to as "liquidation bankruptcy," Chapter 7 involves the sale of non-exempt assets to repay creditors.

Individuals or businesses with minimal income and significant debt may qualify for Chapter 7, allowing for the discharge of most unsecured debts.

Certain assets, such as primary residences and essential personal belongings, may be exempt from liquidation under state or federal laws.

Chapter 13 Bankruptcy:

Chapter 13 bankruptcy, also known as "reorganization bankruptcy," enables individuals with a regular income to develop a repayment plan to settle their debts over a period of three to five years.

Debtors retain their assets while making structured payments to creditors through a court-approved plan.

Chapter 13 is often chosen by individuals seeking to protect valuable assets such as homes or vehicles from liquidation.

Chapter 11 Bankruptcy:

Primarily utilized by businesses, Chapter 11 bankruptcy allows for the restructuring of debts while the business continues operations.

It provides an opportunity for companies to renegotiate contracts, leases, and debt repayment terms with creditors, aiming to achieve long-term viability.

Chapter 11 proceedings involve complex negotiations and court oversight to ensure the equitable treatment of stakeholders.

"Bankruptcy is a legal proceeding initiated by individuals or businesses unable to repay their outstanding debts"

Section 2: How Does Bankruptcy Happen?

Bankruptcy typically arises from financial distress resulting from various factors, including:

Excessive Debt: Accumulation of unmanageable levels of debt due to overspending, medical expenses, job loss, or other unforeseen circumstances.

Business Failure: Inability of businesses to generate sufficient revenue to cover operating expenses, leading to insolvency and bankruptcy.

Legal Action: Creditors may initiate bankruptcy proceedings against debtors who fail to meet their payment obligations, seeking court intervention to recover outstanding debts.

Personal Choice: Individuals overwhelmed by debt may proactively choose to file for bankruptcy as a means of obtaining relief and restructuring their finances.

Regardless of the underlying reasons, bankruptcy offers a legal mechanism for addressing financial challenges and obtaining a fresh start.

Section 3: The Bankruptcy Process

The bankruptcy process involves several stages, each with specific requirements and implications for debtors and creditors:

Pre-Filing Preparation:

Debtors must gather financial documents, including income statements, tax returns, and a list of assets and liabilities, to complete the bankruptcy petition.

Credit counseling from an approved agency is mandatory within six months before filing for bankruptcy, providing debtors with financial education and exploring alternatives to bankruptcy.

Filing the Bankruptcy Petition:

Debtors initiate bankruptcy proceedings by filing a petition with the bankruptcy court, accompanied by relevant financial disclosures and supporting documentation.

The petition triggers an automatic stay, halting most collection activities and legal proceedings initiated by creditors against the debtor.

Meeting of Creditors (341 Meeting):

Within a few weeks of filing, debtors are required to attend a meeting of creditors, also known as a 341 meeting, where they answer questions under oath regarding their financial affairs.

Creditors have the opportunity to question the debtor about their assets, liabilities, and financial transactions related to the bankruptcy case.

Debt Discharge or Repayment:

Depending on the type of bankruptcy filed, debtors may receive a discharge of eligible debts (Chapter 7) or adhere to a court-approved repayment plan (Chapter 13).

In Chapter 11 cases, the court oversees the implementation of a reorganization plan aimed at restructuring debts and maximizing creditor recovery while preserving the debtor's business operations.

Post-Bankruptcy Counseling:

Upon completion of bankruptcy proceedings, debtors must undergo a financial management course from an approved agency, emphasizing responsible financial practices and budgeting.

Section 4: How to Avoid Bankruptcy

While bankruptcy provides relief for those in financial distress, proactive steps can help individuals and businesses avoid reaching such dire circumstances:

Budgeting and Financial Planning:

Maintain a comprehensive budget outlining income, expenses, and savings goals to ensure financial stability.

Monitor spending habits and prioritize essential expenses while minimizing discretionary spending.

Emergency Savings:

Establish an emergency fund to cover unexpected expenses or income disruptions, reducing the need for high-interest borrowing in times of crisis.

Debt Management:

Regularly review outstanding debts and explore options for debt consolidation or refinancing to lower interest rates and monthly payments.

Communicate with creditors to negotiate manageable repayment plans or seek assistance from nonprofit credit counseling agencies.

Diversified Income Streams:

Explore opportunities for additional income through part-time employment, freelance work, or investment income to supplement primary sources of income.

Professional Advice:

Seek guidance from financial advisors, attorneys, or credit counselors to assess financial situations, explore alternatives to bankruptcy, and develop sustainable debt management strategies.

By understanding the different types of bankruptcy, the process involved, and strategies for avoiding it, individuals and businesses can navigate financial challenges effectively and pursue a path towards long-term financial stability. Proactive financial management, budgeting, and seeking professional advice are essential in mitigating the risk of bankruptcy and achieving financial wellness.

Comments